What “Reasonable Steps” Really Mean in 2026: How California Employers Reduce PAGA and Employment Litigation Exposure

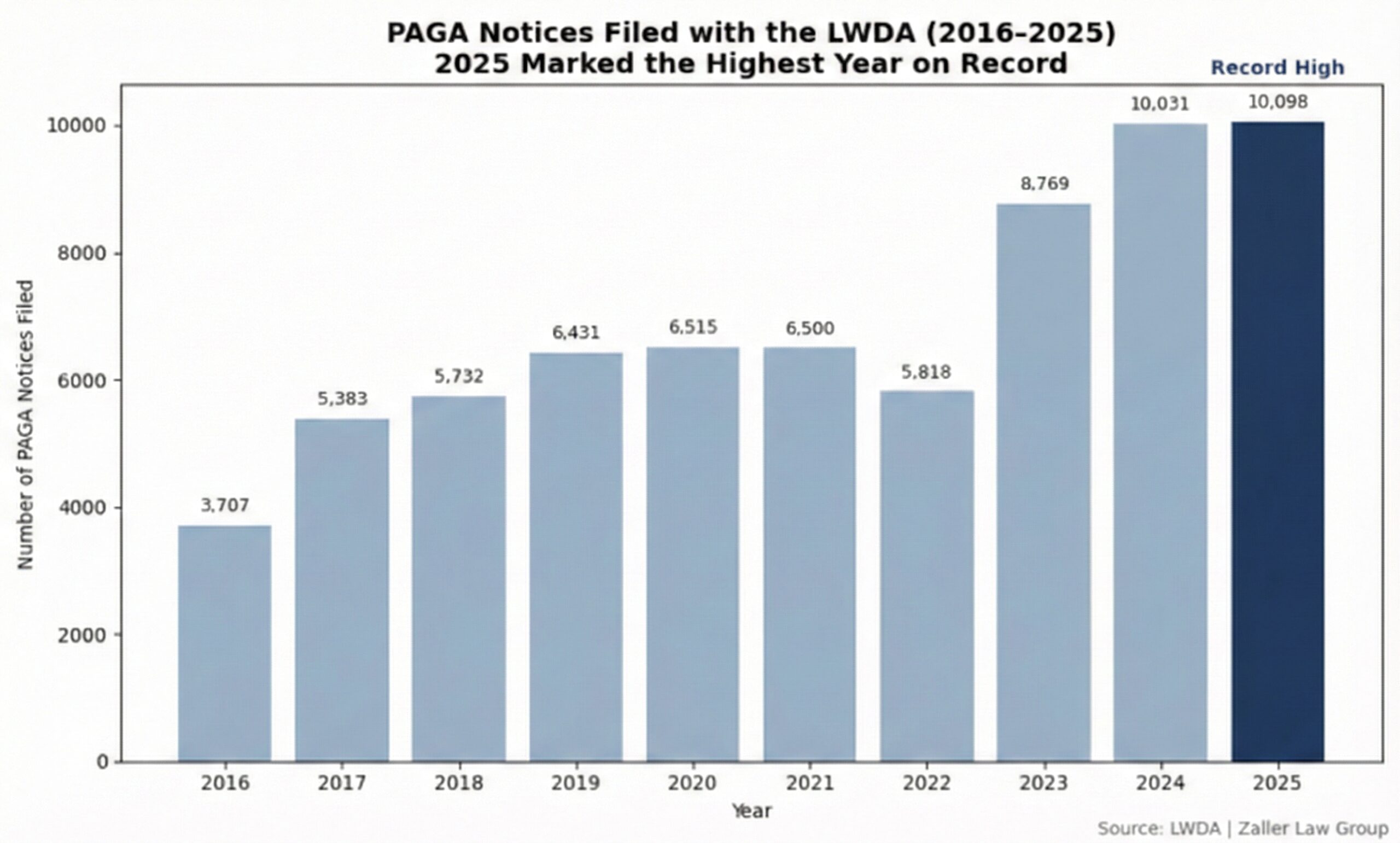

As California employers move through 2026, one thing is clear: employment litigation—and PAGA litigation in particular—is not slowing down.

Despite the highly publicized 2024 PAGA reforms, 2025 became the largest year yet for PAGA LWDA filings. That reality has reset expectations. The reform did not reduce enforcement—it changed how employers must defend these cases.

The new dividing line is no longer simply whether a violation occurred.

It is whether the employer can prove it took all reasonable steps to comply.

While no employer can completely prevent lawsuits, California employers can significantly reduce exposure by focusing on what they can control. The following five steps focus on what can actually work in 2026 for employers that want to reduce risk, cap penalties, and maintain leverage when disputes arise.

1. Prove “Reasonable Steps” Before a PAGA Notice Is Filed

The reformed PAGA statute gives employers something they never truly had before: meaningful penalty reduction tied directly to compliance efforts.

• Employers that can prove they took reasonable steps before receiving a PAGA notice may cap penalties at 15%.

• Employers that attempt to fix issues after receiving notice face substantially higher exposure.

In practice, “reasonable steps” now require more than intent or informal reviews. Employers must be able to demonstrate a repeatable, documented compliance system.

This includes:

- Regular wage-and-hour audits addressing meal and rest break compliance, timekeeping practices, and pay calculations

- Written policies and handbooks that reflect current California law

- Supervisor training with attendance records and materials preserved

- Documented corrective action when issues are identified

- Follow-up audits confirming that fixes were implemented

By 2026, periodic audits by experienced California employment counsel are no longer a best practice—they are increasingly the baseline for employers seeking to limit PAGA penalties.

2. Document Termination Decisions Accurately and Consistently

Termination decisions remain one of the most common triggers for employment litigation. While California law does not require a termination letter in most cases, providing one that accurately states the reason for separation is often a prudent step.

What matters most is consistency.

Plaintiff’s attorneys routinely compare termination reasons against:

- Performance reviews

- Internal emails and messaging platforms

- EDD filings

- Deposition testimony

Employers should avoid “softening” termination reasons or mischaracterizing a discharge as a layoff when performance or misconduct is the true basis. When an employer later attempts to explain that the real reason was different, it can appear as though the company is changing its story—damaging credibility at the outset of litigation.

If a termination is for cause, the documentation should say so clearly and accurately with concrete examples.

Common examples include:

- Documented performance deficiencies

- Policy violations

- Insubordination

- Dishonesty or theft

- Harassment or discrimination

- Excessive absenteeism or tardiness

- Misuse of company resources

Clear, contemporaneous documentation often becomes one of the most important exhibits in early settlement discussions.

3. Use Employment Counsel as a Preventive Compliance Partner

California employment law is highly technical and unforgiving. Employers that treat employment counsel as emergency responders rather than strategic partners often incur greater legal expense over time.

In 2026, sophisticated employers integrate employment counsel into ongoing operations, including:

- Policy and handbook updates

- High-risk discipline and termination decisions

- Wage-and-hour audits

- Supervisor training

- PAGA preparedness planning

This approach allows employers to identify and address issues early—before they become expensive class or representative actions—and often reduces total legal spend by avoiding defensive litigation altogether.

4. Invest in Knowledgeable, Empowered HR Leadership

A capable HR professional does more than administer paperwork. In 2026, HR is a critical risk-management function.

Experienced HR professionals:

- Provide employees with a clear reporting channel for concerns

- Conduct timely, well-documented investigations

- Track complaints, resolutions, and corrective actions

- Serve as a first line of defense against escalating disputes

No organization is immune from employee complaints. The question is whether issues are addressed promptly and professionally—or allowed to fester into litigation.

5. Ensure Ownership-Level Engagement and Accessibility

The most effective step for reducing employment litigation still comes from the top.

In practice, the amount of litigation an organization faces is often inversely proportional to how engaged ownership or executive leadership is with employees. Employers with strong litigation records frequently share common traits: leadership is visible, accessible, and willing to hear concerns.

When employees believe issues will be taken seriously and addressed internally, most disputes never reach a lawyer’s desk. When employees feel ignored or dismissed, litigation often becomes the mechanism they use to be heard.

In 2026, leadership engagement is not just cultural—it is strategic.

Final Thought

California employment litigation has entered a new phase. The question is no longer whether employers can achieve perfect compliance—it is whether they can prove responsible, proactive, and systematic efforts to comply.

For employers willing to invest in preparation, documentation, and leadership engagement, the reformed PAGA statute provides meaningful tools to reduce penalties and control risk. For those who do not, exposure remains as high as ever.

Preparation—not reaction—is what separates employers who manage risk from those who absorb it.